VAT in e-commerce and the one-stop store concept – an overview

Content:

- EU VAT rules for online retailers before July 2021

- VAT eCommerce package: New EU VAT regulations since July 2021

- One-stop store procedure (OSS) after reaching the EUR 10,000 threshold

- Particularities in e-commerce: Consideration of fulfillment services abroad

- Unchanged regulations for sales to non-EU third countries

International deliveries play a crucial role in global economic growth, especially for the e-commerce sector. This aspect has also been recognised by the European Union, which is why it has adapted its tax regulations accordingly since July 2021. These adjustments not only entail the fulfilment of certain requirements, for example from the German Packaging Act (VerpackG) or the General Data Protection Regulation (GDPR), but also impose additional obligations on retailers who ship products to end consumers within the EU.

Would you like to find out more about what has changed since 1 July 2021? Then we have summarised all the relevant changes for you here, including a detailed explanation of the new one-stop shop procedure.

EU VAT rules for online retailers before July 2021

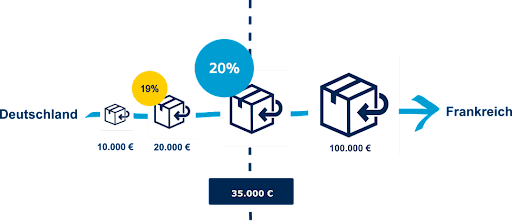

Before the introduction of new rules, online traders who sold their products to other European countries had to regulate VAT according to certain thresholds. These thresholds determined whether the tax was payable in the country of origin or the country of destination of the goods. Each EU member state set its own thresholds, which were usually set at an annual turnover of EUR 35,000 or EUR 100,000.

For example: A German online retailer who sold goods worth more than EUR 35,000 per year to France previously had to register with the French tax office and pay French VAT (20%). If the turnover was below this threshold, German VAT (19%, or at times 16%) was due.

In addition, imports from non-EU countries for goods under EUR 22 were exempt from tax until this date.

Since July 1, 2021, these provisions have largely been replaced by the VAT eCommerce package adopted in 2017 for all EU countries.

VAT eCommerce package: New EU VAT regulations since July 2021

Since July 1, 2021, a uniform EU sales threshold of EUR 10,000 (net) per year has replaced the delivery thresholds previously set individually by each EU country. This means that traders who exceed this threshold in an EU country must pay VAT in the respective country of destination.

In addition, traders who previously remained below the individual country turnover thresholds, but who have a total turnover of more than EUR 10,000 (net) throughout the EU, must pay tax on their products for cross-border B2C deliveries in the respective country of destination (for more information on the turnover threshold, see “Threshold regulation 2021“). A pan-European cumulative turnover threshold now applies. If a trader exceeds this threshold, they will be liable to pay tax in all EU countries in which they sell to private consumers. The previous tax exemption for goods under EUR 22 no longer applies, resulting in an increased tax liability for many retailers.

Example 1: A German retailer who sells exclusively to private customers in Spain and generates an EU-wide turnover of over EUR 10,000 must now pay Spanish VAT of 21% – previously it was 19%.

Example 2: If a German retailer sells to private customers in France, Spain and Italy and only exceeds the EUR 10,000 turnover threshold per year in Italy, they will still be liable for VAT in all three countries as the EU-wide threshold has been exceeded.

As VAT rates in EU countries vary between 17% and 27%, this change can significantly increase costs for many traders. To minimize the administrative burden caused by the need to register for VAT in each country of destination, the One-Stop-Shop (OSS) procedure has been introduced.

Regulations on the turnover threshold from 2021: Procedure until EUR 10,000 is reached

Until the EU-wide turnover threshold of EUR 10,000 per year is reached, entrepreneurs must pay tax on turnover from sales to other EU countries in the country of origin instead of in the country of destination of the goods.

Consideration of German sales in the new EU sales tax regulations

The regulations relate exclusively to sales generated outside Germany. Only cross-border sales within the EU are taken into account when reaching the EUR 10,000 threshold.

One-stop store procedure (OSS) after reaching the EUR 10,000 threshold

The Mini-One-Stop-Shop scheme (MOSS), introduced in 2015, was expanded to the more comprehensive OSS scheme for e-commerce in 2021. Online traders who exceed the EU-wide turnover threshold of EUR 10,000 can use the OSS procedure to declare their turnover in different countries. All EU-wide B2C sales of goods and services are recorded in the OSS system.

Traders can use this system to settle their entire VAT liability from different countries in a single payment. In Germany, the OSS system is administered by the Federal Central Tax Office, which then forwards the VAT paid to the relevant EU countries.

Participation in the One-Stop-Shop procedure is voluntary for traders, but offers considerable advantages and simplifications, especially for smaller traders. Without the OSS procedure, traders who exceed the turnover threshold would have to appoint a tax consultant or service provider for each destination country in order to fulfill the respective VAT obligations abroad. This would not only result in one-off registration costs, but also ongoing monthly costs. By using the OSS procedure, retailers can avoid this expense and conveniently report all sales online.

Particularities in e-commerce: Consideration of fulfillment services abroad

The current OSS procedure does not cover all online retail scenarios. Special cases, such as the use of fulfillment services abroad or sales via online marketplaces, cannot yet be fully integrated into the OSS procedure.

One example of this is the sale of a German online retailer via an Amazon program such as Pan EU or CEE. In such cases, the goods are often stored in a fulfillment center abroad, for example in Poland, and shipped to consumers from there. These processes lead to intra-Community transfers and acquisitions (B2B transactions), which cannot yet be mapped in the OSS procedure. In such cases, traders must either register for VAT directly in the destination country if they exceed the EUR 10,000 threshold, or in Germany if their total turnover in the EU is less than EUR 10,000.

Unchanged regulations for sales to non-EU third countries

The current regulations only apply to B2C sales of goods and services within the European Union. These changes do not apply to transactions with third countries outside the EU. This means that the VAT law of the country of dispatch applies to shipments from the EU to third countries. German VAT law therefore applies to shipments from Germany to non-EU third countries. Here it is particularly important to observe the obligation to provide evidence (further information is available).

LIZENZERO.EU makes packaging compliance in Europe very easy.

Do you ship your products to different countries in the EU? Many different legal requirements and obligations can make the whole thing quite complicated – but don’t worry, we’ll do it for you. How do we do it? With our licensing service, we take over all obligations for you by power of attorney. Sounds good? We’ll be happy to advise you.

For shipping to Germany, you can easily fulfill your packaging obligations yourself via Lizenzero.de.

EPR in Switzerland – Recycling for businesses

Clear EPR obligations already apply in many European countries. Manufacturers and retailers are responsible for the entire life cycle of their packaging and must register with the relevant national systems and pay licence fees. But what is the situation in Switzerland?

EPR UK: current obligations for retailers in relation to packaging

Extended Producer Responsibility (EPR) is a European regulation that makes manufacturers, importers and companies responsible for the life cycle of their products and packaging in accordance with the polluter-pays principle. EU countries can interpret the EPR regulations differently, which is why your obligations may vary from country to country. If you are shipping goods to the UK, you should therefore familiarize yourself with the exact regulations in the country in advance in order to avoid sanctions and be compliant. In the following article, we will give you an overview of the current EPR obligations in the UK and take a look at upcoming changes.

EPR in Portugal: Guide for manufacturers & retailers

Many European countries have packaging licensing regulations, and Portugal is no exception. Companies that deliver packaged goods to or from Portugal must ensure that they comply with the EPR regulations that apply there. But what does this mean in concrete terms? Retailers and manufacturers are obliged to register, licence and label their packaging in Portugal.