The prevention plan in France: eco-design and co.

France has taken a pioneering step towards sustainable eco-design as part of the Circular Economy Act (AGEC). According to this regulation, all companies that place products on the market in at least one of twelve different EPR areas are obliged to submit prevention and eco-design plans.

Legal basis, its areas of application and objectives

The implementation of these plans is based on the AGEC Act of 10 February 2020 and Decree No. 2020-1455 on the reform of extended producer responsibility (EPR). In accordance with Article 72 of the AGEC law and Article L. 541-10-12 of the Environmental Code, manufacturers must submit a prevention plan. The EPR obligations apply to twelve areas, including household packaging, graphic paper, batteries, waste electrical and electronic equipment, textiles and furniture.

Objectives of the prevention plan in France

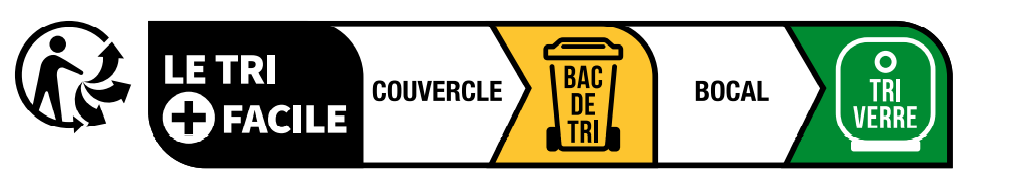

For manufacturers and retailers of products in these areas, this requires the creation of a prevention plan. This plan aims to reduce non-renewable materials, maximise the use of recycled materials and improve the recyclability of products. The overarching goal is to create environmentally sustainable products and services that conserve resources, minimise waste and reduce environmental impact throughout the entire life cycle. France is therefore a leader in the EU in terms of corresponding legal regulations.

Benefits of the prevention plan

The implementation of eco-design not only brings environmental benefits, but can also offer economic advantages by reducing material and energy costs, lowering licence fees for sustainable packaging and improving the brand image. Eco-design is therefore a decisive approach for companies that want to offer sustainable products and services.

Implementation of the prevention plan

The creation of a plan to reduce the environmental impact of packaging and paper has been mandatory for all suppliers since 2023. The prevention plan can be drawn up collectively or individually and must include the categories “Reduce”, “Recycle” and “Reuse”. A follow-up report is required every five years, which contains a review of the previous plan and sets out the targets and measures for waste prevention and eco-design for the next five years.

The submission and regular updating of these plans to the relevant take-back schemes is mandatory after the respective deadlines. Summaries of the plans are published by each scheme every three years and are publicly available.

LIZENZERO.EU makes packaging compliance in Europe very easy.

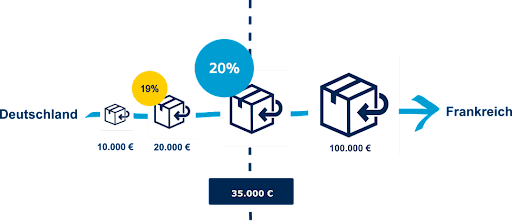

Do you ship your products to different countries in the EU? Many different legal requirements and obligations can make the whole thing quite complicated – but don’t worry, we’ll do it for you. How do we do it? With our licensing service, we take over all obligations for you by power of attorney. Sounds good? We’ll be happy to advise you.

For shipping to Germany, you can easily fulfill your packaging obligations yourself via Lizenzero.de.

Deposit on bottles in Spain: Everything you need to know

Spain wants to introduce a deposit system for single-use drinks packaging in November 2026. For companies that sell drinks in Spain, but also for consumers, the question is: how will the system work and what impact will it have on the market? We therefore take a detailed look at the background, the planned regulations and the challenges associated with the introduction of the bottle deposit in Spain.

EUDR regulation postponed: What changes are coming?

Die Europäische Union hat in den letzten Jahren einen umfassenden Regulierungsrahmen geschaffen, der elektronische Marktplätze vor neue Herausforderungen stellt. Kontrollpflichten zielen so zum Beispiel darauf ab, Verbraucherschutz, Produktsicherheit und faire Handelsbedingungen zu gewährleisten. Doch was bedeutet das konkret? Welche Verantwortung tragen elektronische Marktplätze, und welche Auswirkungen hat das auf Händler:innen, die diese Plattformen nutzen?

Control obligations for electronic marketplaces in the EU

In recent years, the European Union has created a comprehensive regulatory framework that poses new challenges for electronic marketplaces. Control obligations, for example, aim to ensure consumer protection, product safety and fair trading conditions. But what does this mean in concrete terms? What responsibilities do electronic marketplaces have and what impact does this have on retailers who use these platforms?